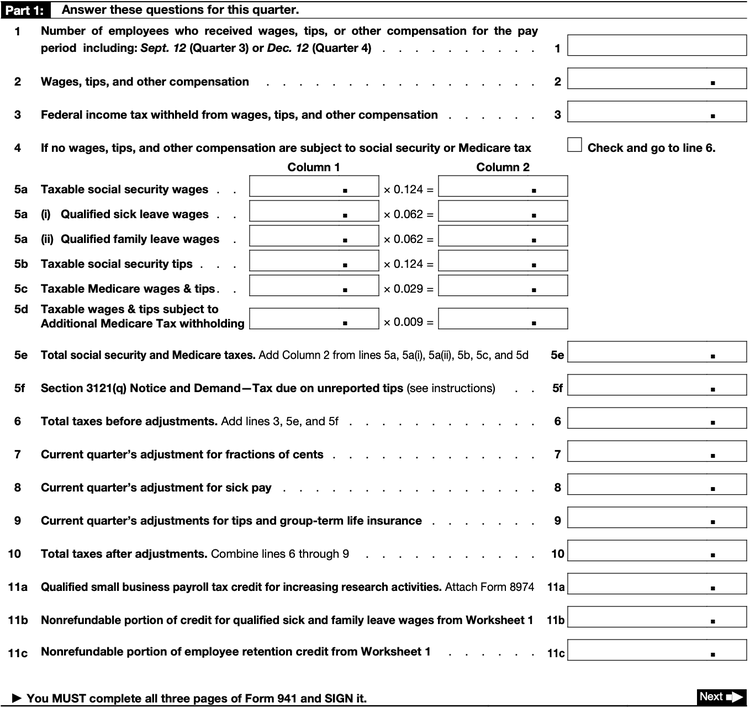

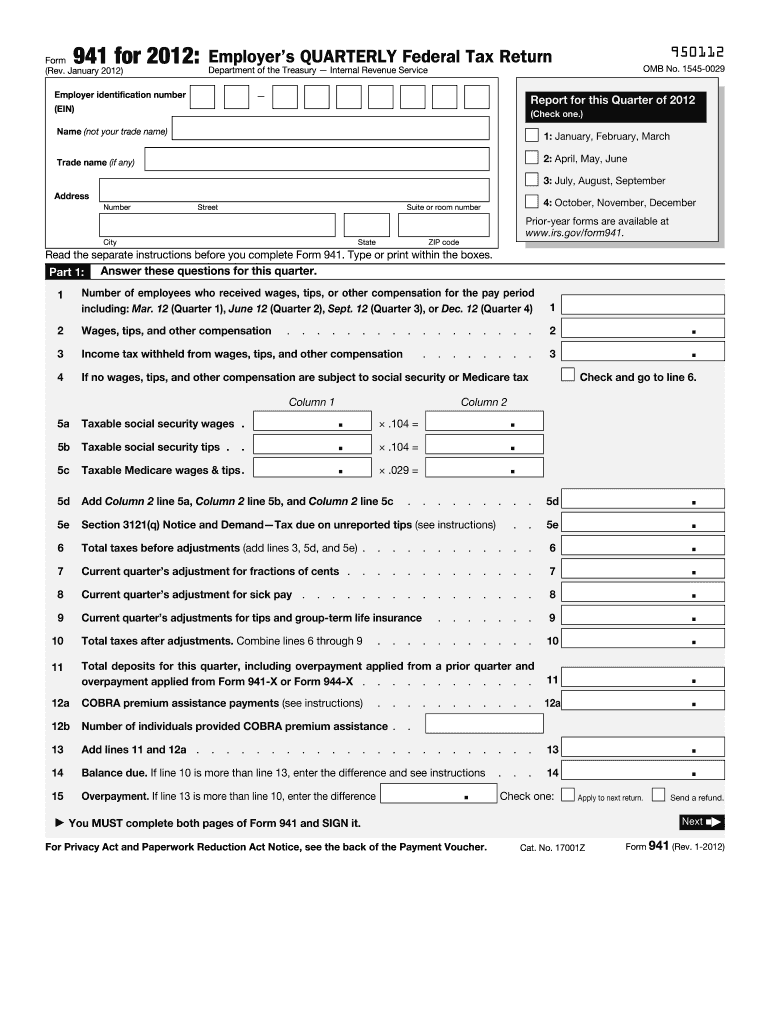

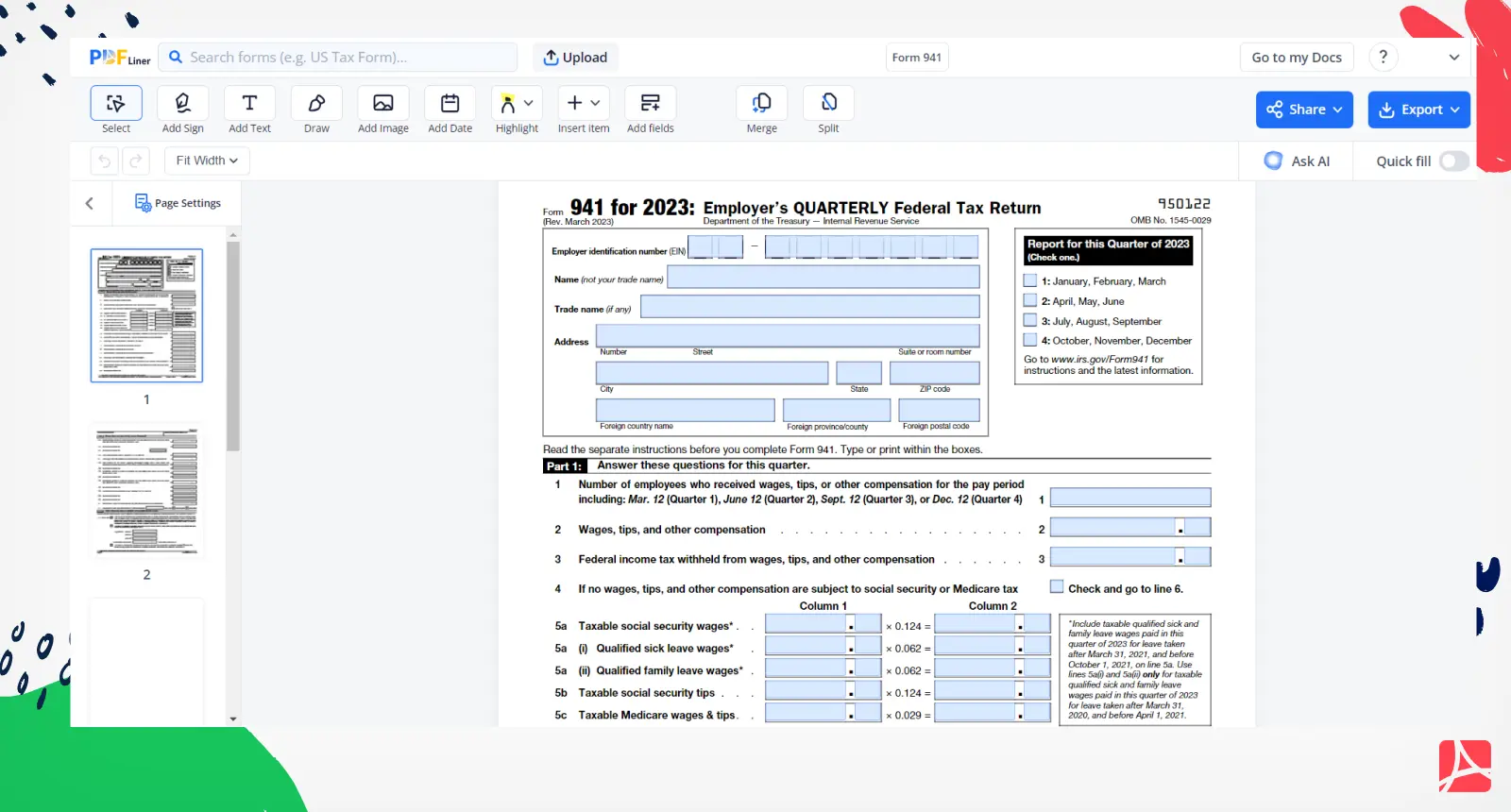

941 Form 2025 Printable Pdf. The period of limitations for making corrections to qualified wages paid is march 13 through march 31, 2025. To file form 941 employer quarterly federal tax return when you have no employee or paid $0 wages for quarter 2 you do the following:download form 941 and it.

To file form 941 employer quarterly federal tax return when you have no employee or paid $0 wages for quarter 2 you do the following:download form 941 and it. The period of limitations for making corrections to qualified wages paid is march 13 through march 31, 2025.

The period of limitations for making corrections to qualified wages paid is march 13 through march 31, 2025.

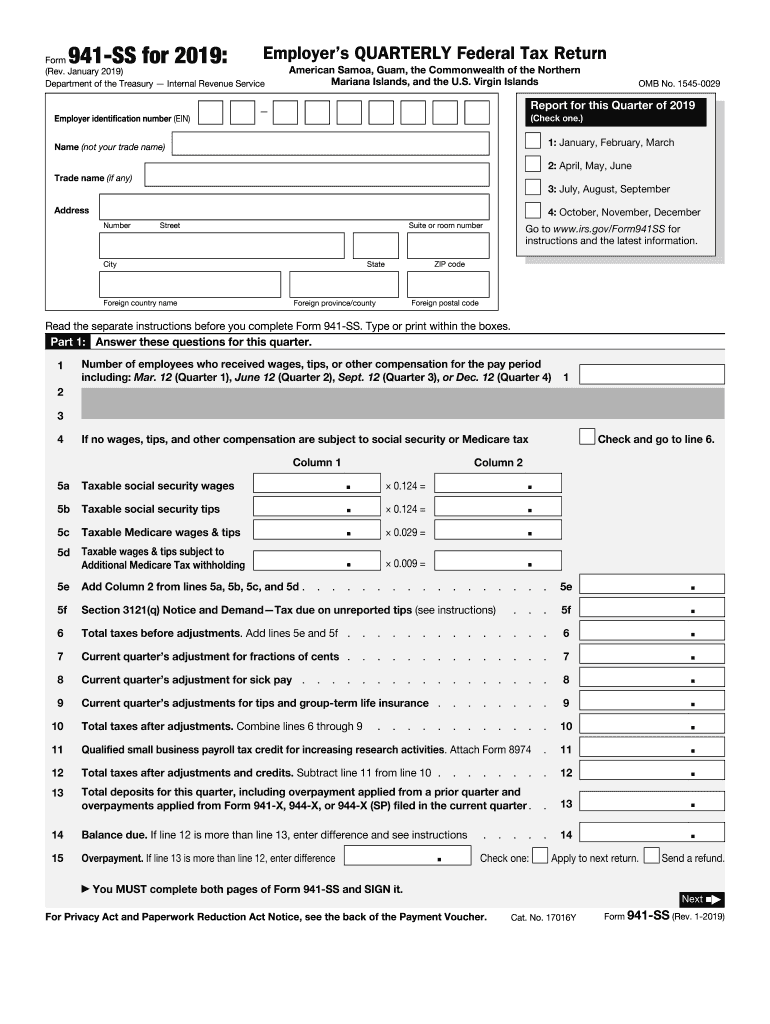

Irs Form 941 Due Dates 2025 Deana Estella, To file form 941 employer quarterly federal tax return when you have no employee or paid $0 wages for quarter 2 you do the following:download form 941 and it. Territory employers will now file either form 941 or the new form 941.

2025 Federal Quarterly Tax Payment Forms Glenda Marlena, The period of limitations for making corrections to qualified wages paid is march 13 through march 31, 2025. To file form 941 employer quarterly federal tax return when you have no employee or paid $0 wages for quarter 2 you do the following:download form 941 and it.

941 Forms 2025 Neysa Adrienne, This generally expires for most employers on april. To file form 941 employer quarterly federal tax return when you have no employee or paid $0 wages for quarter 2 you do the following:download form 941 and it.

Printable Form 941, Territory employers will now file either form 941 or the new form 941. To file form 941 employer quarterly federal tax return when you have no employee or paid $0 wages for quarter 2 you do the following:download form 941 and it.

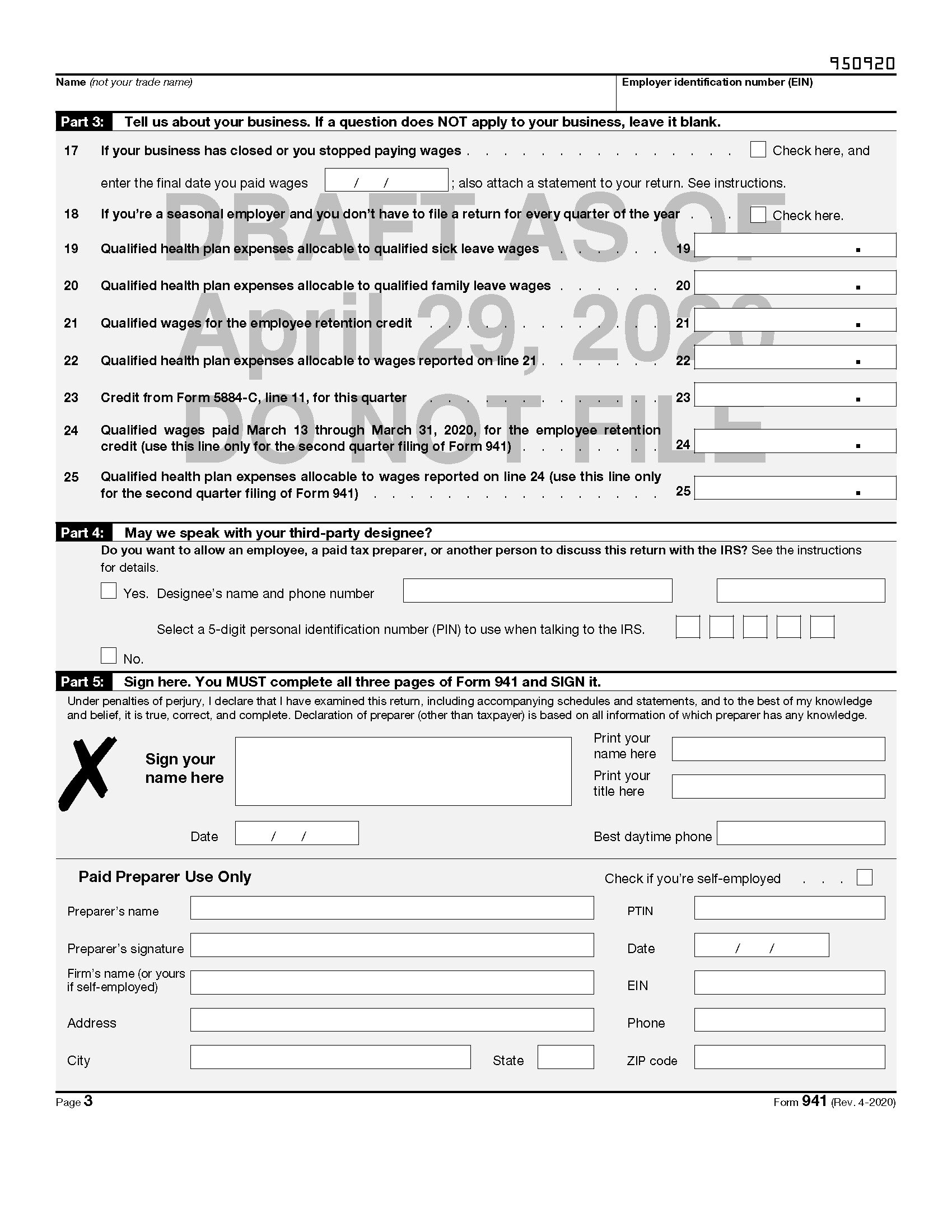

Draft of Revised Form 941 Released by IRS Includes FFCRA and CARES, To file form 941 employer quarterly federal tax return when you have no employee or paid $0 wages for quarter 2 you do the following:download form 941 and it. The period of limitations for making corrections to qualified wages paid is march 13 through march 31, 2025.

Ccc 941 Fill out & sign online DocHub, The period of limitations for making corrections to qualified wages paid is march 13 through march 31, 2025. Territory employers will now file either form 941 or the new form 941.

Irs Form 2025 Schedule A 2025 Pdf molli hyacinthe, To file form 941 employer quarterly federal tax return when you have no employee or paid $0 wages for quarter 2 you do the following:download form 941 and it. Territory employers will now file either form 941 or the new form 941.

Missouri 941 Form 2025 Dodie Freddie, This generally expires for most employers on april. Territory employers will now file either form 941 or the new form 941.

2025 Schedule B 941 Cammy Corinne, This generally expires for most employers on april. To file form 941 employer quarterly federal tax return when you have no employee or paid $0 wages for quarter 2 you do the following:download form 941 and it.

Form 941 fill out form 941 tax 2025, To file form 941 employer quarterly federal tax return when you have no employee or paid $0 wages for quarter 2 you do the following:download form 941 and it. Territory employers will now file either form 941 or the new form 941.

To file form 941 employer quarterly federal tax return when you have no employee or paid $0 wages for quarter 2 you do the following:download form 941 and it.